Mobility aids and accessible equipment can be a great lifeline for people with a disability or health condition but some people may struggle to afford certain products at full price. Thankfully, with VAT exemption, customers with qualifying conditions can get VAT relief of 20% on eligible items.

Here at Disability Horizons, we go through everything you need to know about VAT exemption – what it is and how it works, who is eligible and how you claim on products in our online shop.

What is VAT?

Value Added Tax (VAT) is a tax, which is payable on sales of goods or services. In the UK, VAT rates are at 20%. This means every time you pay for a product such as food, clothes, technology or a service like building work, you’ll be charged an additional 20% on top of the price of the good or service.

What is VAT exemption and how does it work?

Living with a disability or health condition can be more costly with the need for additional aids, equipment and support. Therefore people with qualifying conditions can be eligible for VAT exemption on certain goods and services.

Which goods are exempt from VAT?

Products that are exempt from VAT are usually items designed or adapted for a disability or health condition. For example:

- adjustable beds

- stairlifts

- wheelchairs and mobility aids

- medical appliances

- alarms

- blind or low vision aids – but not spectacles or contact lenses

- motor vehicles – or the leasing of a Motability vehicle

- building work – like ramps, widening doors, installing a lift or toilet

Who qualifies for VAT exemption?

To get the product VAT free your disability has to qualify. For VAT purposes, you’re disabled or have a long-term illness if:

- you have a physical or mental impairment that affects your ability to carry out everyday activities – for example, cerebral palsy, muscular dystrophy, blindness, deafness and learning disability

- you have a condition that’s treated as a chronic illness – for example, diabetes, chronic fatigue syndrome and arthritis

- you’re terminally ill – for example, motor neurone disease, cancer and heart disease

You do not qualify if you’re elderly but not disabled, or if you’re temporarily disabled.

If you’re not sure if your condition means you’re chronically sick or disabled you may wish to consult your doctor or another medical adviser.

VAT exemption for charities

Charities pay VAT on all standard-rated goods and services they buy from VAT-registered businesses. Charities get a 5% reduced VAT rate for fuel and power of buildings and vehicles.

For more specialist and adapted goods and services, charities are eligible for full VAT exemption. Organisations that support disabled people can get VAT relief on products such as:

- aids and equipment for disabled people

- construction services – eg installing ramps, lifts and accessible toilets

- drugs and medicines

- adapted/wheelchair accessible vehicles

You can find out more VAT exemption for charities on the gov.uk website.

Do international customers pay VAT?

International customers purchasing products from the UK don’t pay VAT whether disabled or not. The site will take it off when the address is put in at checkout.

However, you may be charged an import duty, sales tax or VAT equivalent in your own country by customs. The rules are complex and vary, so please check before ordering. Some countries (like Australia) allow imports below a certain value without additional taxes.

Others, like Canada, require us to use a specific tariff import code for disability products to allow zero duties. Please advise us by email if this is applicable.

We cannot predict exactly what import duties will be charged by overseas customs and couriers. You will be responsible to pay those charges to receive your items.

Also, you may have additional postage charges, depending on where you live and what you are ordering. We suggest you email us at shop@disabilityhorizons.com for a quote and we can work out exact shipping costs.

How to claim VAT exemption

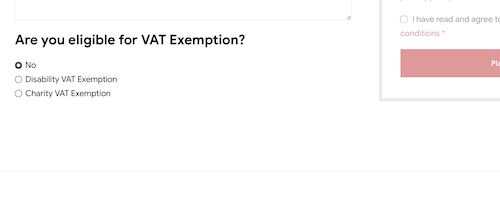

To claim VAT exemption on products on the Disability Horizons Shop, you simply fill in a short online form at checkout. Once you’ve filled out your billing and delivery information, you’ll see a “Are you eligible for VAT Exemption?” section.

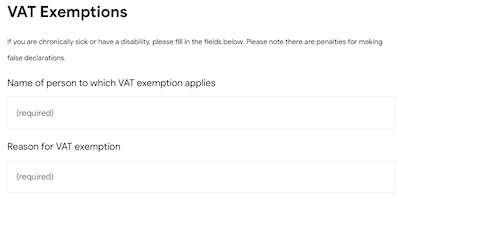

If you’re a disabled individual or buying on behalf of a disabled person, select “Disability VAT Exemption” and enter the name of the disabled person and their qualifying condition.

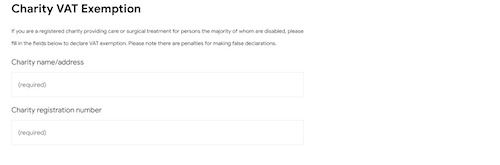

If you’re purchasing on behalf of a charity, select “Charity VAT Exemption” and enter the charity’s name and registration number.

You are not required to give proof of your eligibility or provide a VAT exemption certificate. However,there are penalties for making false declarations. The team at Disability Horizons will take care of declaring VAT exemptions to HMRC.

VAT exempt products on the Disability Horizons Shop

Many of our stylish, functional and accessible products include VAT exemption for qualifying conditions. Here are a few of our most popular items that include VAT relief:

- Glideboard transfer board – an ultra-lightweight transfer board with a unique design to increase stability. The sliding seat panel glides, making transferring from anything easier and safer, reducing effort by more than 30% and minimising friction.

- Functionalhand – universal grip aid for poor hand function – a grip aid that holds objects of different shapes and sizes firmly and securely. It can be used in both a vertical and horizontal grip and features an easy-adjust tightener that secures objects in place to prevent slipping.

- Hitch mobility scooter trailer for kids – a lightweight, portable trailer for children that attaches to mobility scooters – a truly innovative product to make life easier and more fun.

- AbleSling Lite – discreet sit-in sling for manual transfers – a fantastic discreet sit-in manual transfer sling that has been designed to be extremely universal and applicable for a whole manner of situations, such as air travel, medical appointments and taking part in sports and activities.

- Friendly Shoes – adaptive shoes that are high-quality, functional, comfortable, and versatile, which feature large entry portals, wide and generous toe space, memory foam insoles and an amazingly lightweight design.

VAT is a complex area of tax law and we will help as much as we can. However, you should refer to the gov.uk pages and the VAT helpline for expert help.

By Disability Horizons

More on Disability Horizons…